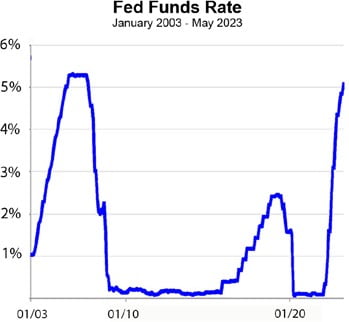

Starting in February of 2022, the Federal Reserve began increasing the Federal Funds Rate to bring inflation under control. Through May 2023, rates rose faster than in any previous cycle. In the process, the Fed brought back to the spotlight a risk many investors had disregarded after more than a decade of low interest rates – interest rate risk. 2022 was the worst year on record for bonds, according to Edward McQuarrie, an investment historian and professor emeritus at Santa Clara University.

U.S. government securities are considered among the safest investments in the world. Held to maturity, U.S. bonds are expected to maintain the same cash value as their initial issue terms. If one needs to liquidate a bond position prior to maturity, however, prevailing interest rates and the remaining time to maturity, i.e. duration, determine the cash value of the bond. With bond investing, when interest rates rise, bond prices fall, and vice versa.

One way to think of bond values is the competition for return. If an investor can purchase a new bond with the same maturity date paying 5%, an existing bond’s price needs to be discounted to produce a competitive 5% return if sold.

Duration risk is the name economists give to the sensitivity of a bond’s price to a 1% change in interest rates. Duration also affects bond funds. For example, a bond fund with 10-year duration will decrease in value by 10% if interest rates rise 1%. On the other hand, the bond fund will increase in value by 10% if interest rates fall 1%.

In addition to maturity – the length of time before the bond’s principal is repaid, variables such as how much interest a bond pays during its lifespan as well as the bond’s call features and yield, which may be affected by changes in credit quality, play a role in the duration calculation.

While rising interest rates provide better returns on new debt investments, there’s typically little in the way of good news for borrowers when interest rates increase. Variable rate loans see a noticeable interest rate increase when they adjust, and the cost/interest rate of new loans increases.

A great many businesses depend upon variable rate lines of credit to purchase or manufacture products and repay the line of credit as products are sold. For the businesses to continue to be viable, increased interest rates are passed along to buyers. Interest rates for commercial real estate loans typically adjust every five years, adding more interest rate pressure on owners of business property from office buildings to retail, industrial and residential buildings.

To put costs in terms of the average person’s budget, it may help to consider the impact of higher interest rates on mortgage interest paid over the life of the loan.

$400,000 30-year, fixed-rate mortgage

| Payment: Principal and interest | Total Interest Expense | |

| 3.0% APR | $1,686 | $270,000 |

| 5.5% APR | $2,271 | $417,616 |

| 7.0% APR | $2,661 | $558,035 |

Over the 30-year life of the loan at 7%, interest payments will exceed the original loan balance. Higher payments make qualifying for loans more difficult and buyers may need to lower the amount they can borrow to qualify.

The biggest negative impact of rising interest rates will hit the biggest borrowers, which are almost inevitably governments. With more than $31.42 trillion in outstanding U.S. debt in December 2022, many investors are considerably poorer in terms of the cash value of their U.S. government securities. To persuade those investors to purchase more government debt will require higher interest rates.

States and local governments have an additional $4 trillion plus in outstanding loans. Higher interest rates will take their toll when outstanding obligations are rolled into new debt offerings, or additional funds are raised through new borrowing. An improving economy with increasing tax collections could offset higher interest rates, however, the Federal Reserve’s goal in imposing higher interest rates is to depress the economy to lower the rate of inflation.

So far, the U.S. economy is holding up admirably in the face of higher interest rates, with a continuing strong job market, leaving future interest rates uncertain. Will inflation fall off, allowing lower interest rates, or will continuing inflation keep the rate pressure on?